Basic of Investment

An investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or appreciate and be sold at a higher price.

Our Investment Approach

Investment process which, we believe, fully integrates clients’ assets, is conscious of their investment risk parameters and requirements, and is transparent and fully interactive. On your right we give an overview of this process.

Investment Strategy Formulation

Once we have been informed of a clients investment objective, we will propose an investment strategy that, we believe, is most aligned with those requirements and objectives. Our investment strategy will include both asset and security selection proposals.

EQUITY

We make equity trading easier, more predictable, and more rewarding for our customers. Whether you are a long-term value investor or a day trader; a beginner or a professional investor looking to trade on leverage, we provide you with access to various investment and trading products, sound research and advice and secure tools to help you achieve your goals with ease

- SIP is an investment strategy wherein an investor needs to invest the same amount of money in a particular mutual fund at every stipulated time period.

- Systematic Investment Plan is an investment strategy wherein an investor needs to invest the same amount of money in a particular mutual fund at every stipulated time period.

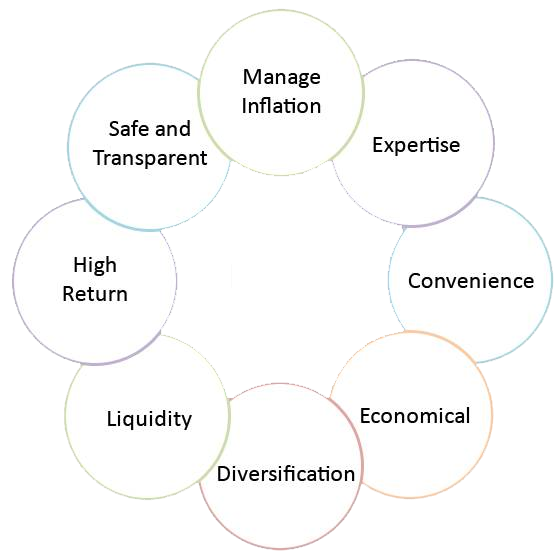

MUTUAL FUNDS

Mutual funds are ideal for investors who want to invest in various kinds of schemes with different investment objectives but do not have sufficient time and expertise to pick winning stocks. Mutual funds give you the advantage of professional management, lower transaction costs, and diversification, liquidity and tax benefits.

Diversification

Mutual funds give you access to a diversified portfolio and helps you reduce your overall risk. It also allows you the opportunity to invest small sums in varied investment schemes

Professional Management and Well Regulated

Mutual Funds are managed by experts and well regulated by SEBI and hence it allows you to sit back and relax without having to worry about researching, buying and selling at the right time as compared to stocks

Disciplined Investment Approach

In Mutual Fund, investor has an option to have disciplined investment transaction on a regular basis through SIP |STP | SWP i.e. Monthly/weekly/quarterly etc.

Low Transaction Costs

Economies of scale allow you to pay lower transaction costs compared to an individual who enters the market directly.

Liquidity

Mutual funds are liquid in nature and easy-to-sell whenever you wish to

Tax Benefits

Equity Linked Savings Schemes (ELSS) qualifies under Section 80C of the Income Tax Act for tax deductions. Besides this, all interest or dividend income from the investments in mutual funds, are exempt from tax.

Indian Currency Futures Market – Present Status

Currency Futures Trading was launched in India on 29th August, 2008 on NSE. NSE & MCX’SX are the major 2 exchanges presently. “United Stock Exchange of India” is the upcoming exchange promoted by Bank of India, Federal Bank, MMTC & Jaypee Capital along with 9 other banks.

The FX market in India is regulated by The Foreign Exchange Management Act, 1999 or FEMA, Presently Daily Turnover on both exchanges averages Rs. 35000 crores. Banks are active participants on the exchanges. NRIs & FIIs are not permitted to trade as of now. Currency markets offer investors a step into the world of Forex.

The global increase in trade and foreign investments has led to inter-connection of many national economies. This and the resulting fluctuations in exchange rates, has created a huge international market for Forex rendering investors another exciting avenue for trading. The Forex market offers unmatched potential for profitable trading in any market condition or any stage of the business cycle.

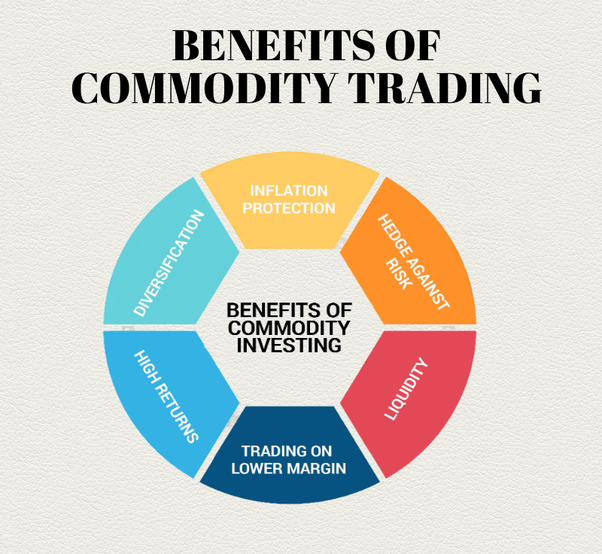

COMMODITIES

Commodity trading brings a basket full of diverse avenues for investment, away from the traditional avenues of equity, bonds and real estate. Based on the historical data, adding commodities exposure to your existing portfolio helps you increase the returns while lowering the risk. Commodities have very little or negative correlation with other asset classes.